Owning your own home is one of the great financial goals anyone can make. With so many people renting because they struggle to make mortgage payments or simply don’t have good enough credit for a principal amount, the Mortgage Calculator Template is here to help you play with different amounts to find a plan that suits your needs.

How to Use the Mortgage Calculator Template

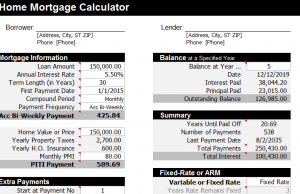

Start by entering your contact information in the top left corner of the page. Next to your information, you will enter the contact information of your lender.

With that out of the way, you are free to start playing with some figures. If you’re interested in a property and want to know what you’ll be paying in monthly fees and other helpful information, fill out the “Mortgage Information” section of the Mortgage Calculator.

In this section, you will enter the loan amount, annual interest rate, term length, first payment date, compound period, and your payment frequency.

This information will give you important details about your loan that may influence whether or not you want to purchase a particular home.

If you scroll towards the bottom of your screen you’ll see your “Payment Schedule”. This is a complete breakdown of all your payments you’ll be making from month to month until your new home is paid off.

You can also change your payment amount and the template will automatically update your payment schedule to reflect your updated figures.

When you have all the required fields filled out, you can go to the “Summary” section of your template to get a comprehensive overview of your mortgage. In this section, you can view the number of years you have left to pay off your debt, your number of payments, and everything else you’ll need to stay on top of your mortgage.

Use the Mortgage Calculator to find a plan that works best for you.

Download: Simple Home Loan Calculator

Check out this offer while you wait!