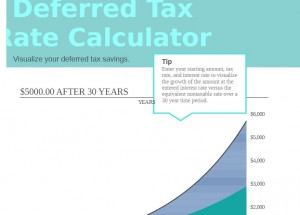

The Deferred Tax Rate Calculator makes finding both the equivalent taxable rate and equivalent non-taxable rate as simple as possible. This template was designed to make getting this information as fast and convenient for you as possible All you need to do is follow the directions below to find out how much you could be saving by downloading the free Tax Rate Calculator today. Don’t be left in the dark about how much you’re spending a month, use this calculator to find out for sure.

How to Use the Deferred Tax Rate Calculator

The first thing you’ll need to do is download the free template to your computer. To do this, you need to click the link located at the bottom of this page.

Since the Deferred Tax Rate template is in fact just a simple calculator, all you’ll need to do is enter a few items to receive the information you need.

The first thing you will enter is the starting amount at the top of the page to the right. Simply click inside the cell and enter the figure in dollars.

Next, the cell directly below the “Starting Amount” allows you to enter your current tax rate. This is the rate that will be compared to a deferred interest rate in the chart to the left.

The last item you’ll enter is your current interest rate. The template is already formatted to change the amount you enter into a percentage for your convenience.

Now, watch as the “Equivalent taxable and non-taxable” sections are filled with the information you need. In the example, the equivalent taxable and non-taxable are displayed in gray as 12% and 6.8% respectively.

Even better, you can see the amount you spend over time in both situations by glancing over to the handy graph to the right.

Now you can make well-informed decisions about deferred taxes by downloading the free Tax Rate template.

Download: Deferred Tax Rate Calculator

Check out this offer while you wait!