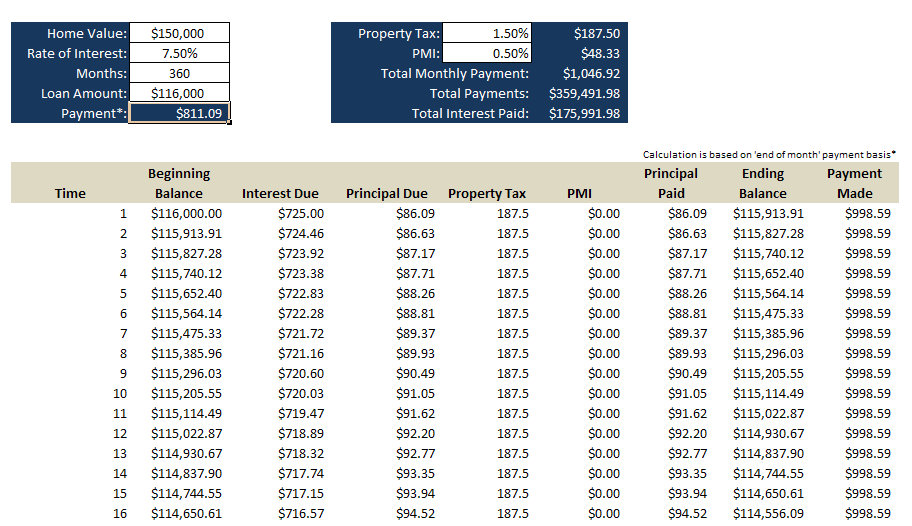

When buying a home for the first time, there are many extra expenses that will also have to be taken into account. Many first-time home buyers do not keep these extra expenses in mind when they are considering just how much “house” they can actually afford. Expenses such as insurance and taxes will factor into the buying power of a potential real estate customer. That is why the skill of using a Mortgage Payment Calculator with Taxes and Insurance can be a life-saver for those who wish to factor in these extra expenses.

Thus, the purpose of this article is to educate home buyers on this very important skill. Moreover, our Mortgage Payment Calculator is available right on our webpage and can be fully modified to fit any Excel document as well. Our easy-to-use template is fully downloadable on our site as well.

How to Use a Mortgage Payment Calculator with Taxes and Insurance

- First, enter the amount of the sale price of the property in the box entitled “purchase price”, which is usually at the top of the calculator.

- Second, enter the percentage of the down payment and the mortgage term (in years) in the next two corresponding boxes.

- Third, enter the amount of the interest rate in the next box and the amount of your annual property tax obligation in the following box.

- Finally, in the last two boxes of the Mortgage Payment Calculator with Taxes and Insurance enter your annual property insurance expense and your zip code.

Tips for Using a Mortgage Payment Calculator with Taxes and Insurance

1. Use this for determining your budget for a new home.

Use this mortgage calculator to fully determine your buying power and to allow for the oft-overlooked costs of home ownership, such as taxes and insurance.

2. Use this for determining what loan term you should use.

Because this calculator is fully adjustable, go ahead and experiment. Instead of an ordinary 30 year mortgage, see what the payment would be for 20, 15, or even a 10-year term.

3. Use this Mortgage Payment Calculator with Taxes and Insurance to determine your amortization schedule as well.

When paired with Excel, this calculator would be very beneficial in viewing how the payments on the home will look at different times during the life of the loan.

Download: Mortgage Payment Calculator With Taxes and Insurance

Check out this offer while you wait!