Investors need a fast and easy way to compare competing investment opportunities. A compound interest table is a rapid way to calculate the exponential growth of an interest bearing investment over time, and is one of the many tools that investors rely upon to evaluate investing alternatives. With such a tool, you can easily observe how any interest earning investment vehicle performs over time, and you can track the growth and progress of your hypothetical investment program on a month-to-month basis. The preferred method of getting at this data is to create a visual representation of it using a compound interest table template.

Investors need a fast and easy way to compare competing investment opportunities. A compound interest table is a rapid way to calculate the exponential growth of an interest bearing investment over time, and is one of the many tools that investors rely upon to evaluate investing alternatives. With such a tool, you can easily observe how any interest earning investment vehicle performs over time, and you can track the growth and progress of your hypothetical investment program on a month-to-month basis. The preferred method of getting at this data is to create a visual representation of it using a compound interest table template.

Using the Compound Interest Table Template

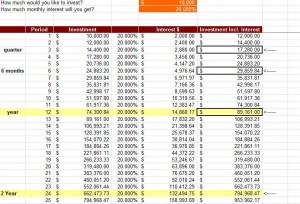

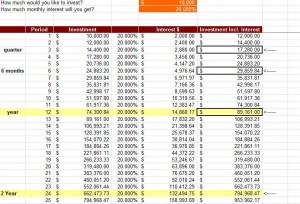

In order to accurately calculate the earnings accrued over a two-year period for a $10,000 investment according to different rates of interest compounded monthly, you would need to begin with some already established pieces of data. You should start with (R) which stands for the interest rate you expect to earn. If you intend for (R) to be equal to a 6% annual rate of interest, then R = 6/12, where 6/12 (one-half percent) equals the rate of interest earned per compounding period (or months) in this example.

Next, you need to establish a value for (N) where (N) represents the number of periodic payments that you intend to observe for the purposes of this exercise. In this exercise, N = 24, or N equals two 12-month time periods or twenty-four months. These two pieces of data are input into your compound interest table template.

Your next task is to input the amount of your proposed initial investment that in this case is $10,000 and is represented by (PV) or “present value”. Be advised that some variations of your compound interest table template will require you to input how your interest is compounded. In this example, you would input “monthly”.

Also some templates will require that you determine whether your interest should accrue at the beginning of each month, or at the end. This factor will have such a tiny influence on your overall results that you can safely choose either one as long as you are consistent with respect to evaluating all your investment ideas the same way.

Download: Compound Interest Table Template

Check out this offer while you wait!