Keeping track of what money is owed and when it is due is a critical part of managing a business. An accounts payable aging spreadsheet is an important tool in the effort to ensure that bills are paid in a timely manner and a company manages its cash flow wisely.

Keeping track of what money is owed and when it is due is a critical part of managing a business. An accounts payable aging spreadsheet is an important tool in the effort to ensure that bills are paid in a timely manner and a company manages its cash flow wisely.

What is An Accounts Payable Aging Spreadsheet?

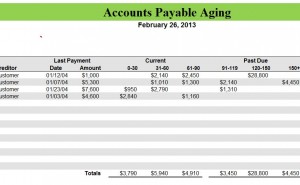

An accounts payable aging is simply a listing of the bills that a company owes, broken down by due date in selected date ranges, typically in 30-day increments. This spreadsheet gives financial managers an easy way to determine when bills need to be paid and how much cash the company will need in order to pay them. It can be especially useful for a company that is operating on a tight budget. With a quick overview, the manager can determine the due date of bills and prioritize payment based on the available cash.

While it is possible to create an aging manually, moving the information from line to line and aging category, an Excel template makes the work much easier. You simply enter the relevant information when a bill is received and the template sorts it into the correct aging category. When checks are cut, you mark the bills that are paid and they are removed from the aging.

Updated reports are available with the push of a button, with the template doing the work of determining which aging category in which each remaining bill belongs. You are presented with one neat, easy to read report that shows you at a glance how much money the company owes, to whom it is owed and when the bill is due.

Excel templates make managing your company’s cash flow easier and less time consuming. Simple data entry steps create easy to read aging reports that help you keep track of the bills that need to be paid on any given day. These templates will help ensure that bills don’t get overlooked and that you are using your company’s money in the best way possible. This template is instantly downloadable below.

Download: Accounts Payable Aging Spreadsheet

Check out this offer while you wait!