The hardest part of attending college is not the coursework or time commitment required from the student, but the financial commitment made by parents. And with tuition rates increasing almost every year, it can be hard to predict exactly how much you’ll need to save in order to afford it when the time comes. The goal of this customizable Excel college cost calculator is to help parents calculate this amount and invest properly for their children’s future.

The college costs calculator is a free template for Microsoft Excel and can be customized to suit your needs and expectations. The college costs calculator can be quickly downloaded and is quite easy-to-use—you’ll simply enter in the required information to the best of your ability and the template will provide you with an estimated amount you’ll need to invest annually to afford your children’s education. This cost of college calculator will take into account any investments you currently have, and will automatically adjust for inflation.

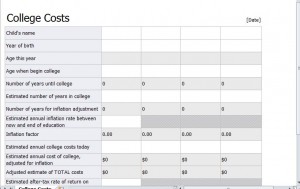

How to Use the College Cost Calculator

- Download the free, easy-to-use cost of college cost calculator from this website and open it in Microsoft Excel.

- Working your way down, begin filling in the empty white cells and watch the cost of college calculator automatically fill in the gray cells as you go. Keep in mind that the contents of the gray cells will become more accurate after all of the white cells are completed.

- Save or print the completed college cost calculator template for future use.

General Tips for Using the College Cost Calculator

- The lined, dark-gray cells use the value in the adjacent white cell and do not need to be filled out.

- Once you enter information for one child, you can enter in three more using the same template.

- According to Financial Aid sources, when tuition rates increase, they generally do so at about double the general inflation rate, which is typically between 3% to 4%. So if you’re unsure, entering an “estimated annual inflation rate” of 6% to 8% is acceptable (although far from guaranteed).

- The “estimated after-tax rate of return on savings and investments” cell refers to the interest you stand to make on your investments, such as from any college savings plans, certificate of deposits, money market accounts and savings accounts you may have.

Download the College Cost Calculator from Microsoft Office: College Cost Calculator

Check out this offer while you wait!