The business debt calculator is a great tool to have for any business, large or small. It can be used in order to track all of the business’s indebtedness. Businesses can use this debt calculator template in order to figure out where their funds are being spend, who they owe money to, and how much money is going out on a monthly basis. They can easily see what accounts need to be paid off and the amounts of interest rates that are being charged to them.

How to Use a Business Debt Calculator

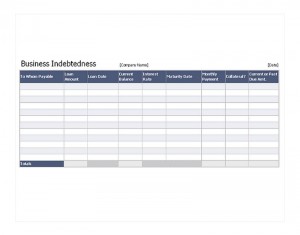

Each of the column names are listed across the chart as follows:

- To whom payable

- Loan amount

- Loan date

- Current balance

- Interest rate

- Maturity date

- Monthly payment

- Collateral?

- Current or Past due amount

The bottom of the chart will list all of the totals combined for each of the sections. You could set the chart up to add the columns for you to make the process faster each time you input information on the chart. For example, you may want to set it up so that the balances will all combine together in that column.

Tips for Using a Business Debt Calculator

- The company can place their company name and the date the chart is being made on at the top of the chart.

- The chart can be customized to fit the business’s needs and ensure that it has every field needed for the business to fill out the chart properly.

- Companies will be able to use the business debt calculator to see what accounts are current or past due. This way they can focus on the past due accounts to ensure they are brought current.

- Businesses can eliminate debt and pull up their records faster with this chart instead of having to look for the debt on its own.

Our business debt calculator is easy to use. It is customizable to fit your company’s needs. Be sure to download the template today right from this page for free!

Download: Business Debt Calculator

Check out this offer while you wait!