The debt reduction calculator template is a great tool to use when you are trying to figure your personal debt. It will advise you if the debt you have to to much for your personal finances. This will help guide you to know what debt you need to eliminate faster to get your debt to ratio percentage lowered.

How to Use a Debt Reduction Calculator

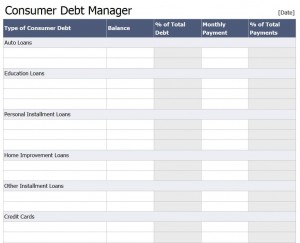

Each section listed across the template is:

- Type of Consumer Debt

- Balance

- Percentage of Total Debt

- Monthly Payment

- Percentage of Total Payments

The following is listed down the template to separate categories:

- Auto Loans

- Education Loans

- Personal Installment Loans

- Home Improvement Loans

- Other Installment Loans

- Credit Cards

- Home Equity Line of Credit

- Loans on Life Insurance

- Margin Loans from Broker

- Other Loans

- Totals

At the bottom of the debt reduction calculator is:

- Monthly Income

- Safe Ratio and Safe Monthly Payment

- Actual Debt Ratio and Monthly Payment

This section will be automatically calculated by the template.

Tips for Using a Debt Reduction Calculator

- This template is customizable. You can take out the loans not needed or add in others.

- Be sure to fill in the numbers correctly for the section they go in. This will ensure your totals will be calculated properly.

- You can add more rows under the type of loans you need to add more information on.

Our debt reduction calculator template is easy-to-use. It can be downloaded for free right off of this page. Be sure to download your template today and customize it to fit your needs. You will be able to figure your debt to income ratio easier and see where you need to focus your funds to get you out of debt quickly. This personal tool will help give you the figures you need to ensure you are sending in big enough monthly payments to eliminate the debt.

Download: Debt Reduction Calculator

Check out this offer while you wait!