Unfortunately, depreciation is simply something that happens to some items over time, whether you’re thinking about buying a car or a home. That doesn’t mean you have to settle with a poor offer or deal on that item because of the fact. The Different Depreciation Methods Sheet is here to help people that want to compare the depreciation of items with different methods, products, or businesses and see how you can get the best deal by choosing the right path. The template shows you exactly what you need to fill out. If you’re interested in using this free and simple template to compare different depreciation options, then read the set of instructions below to get started.

How to Use the Different Depreciation Methods Sheet

Downloading the free template is as simple as clicking the link at the bottom of this page. Once you have the document, open the file to start customizing.

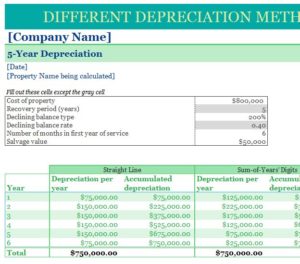

The template gives you 4 different options to start. Choose whether you want to compare depreciation over 5, 7, 10, or 15 years then select the corresponding tab at the bottom of your screen to be navigated to the appropriate page.

Next, start at the top of your chosen tab and enter the date and the property names. This will help you keep your information organized in case you want to compare different properties as well.

The next step is to list the cost of the property, recovery period, declining balance type, number of months in the first year of service.

The green table below the information you just filled out is where you can see your depreciation rates for straight line, sum-of-year, and declining balance methods of depreciation of the next five years for your property.

The last table of the document provides you with a convenient overview of this information as well. If you want to compare different properties, simply copy the blank document and repeat the process with the other property’s information.

Make the best decision for you with the free Different Depreciation Methods Sheet.

Download: Different Depreciation Methods

Check out this offer while you wait!