The comprehensive Financial Cash Flow Workbook is one of the best tools for structuring your income and expenses. Analyzing this data and using the available trends gives you a better understanding of successful sale strategies. You can customize the template to be tailor-made for your personal business for that important first year of operation!

Financial Cash Flow Workbook Instructions

The template comes with a list of helpful instructions to get you started; on the first tab. The “Profit and Loss Forecast” is a month-by-month method for entering sales when they’re invoiced, rather than the month when they will be paid.

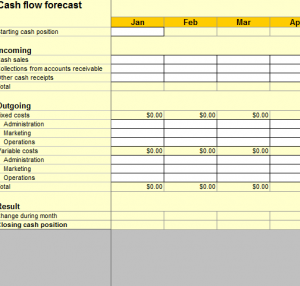

Next the “Cash Flow Forecast” tab allows you to enter all of your incoming and outgoing cash flow. This template will track the first 12 months of your new business venture. Simply enter your business’s sales revenue in the month when it’s received and you’ll be all set!The “B

alance Sheet Forecast” is a balance sheet positioned at the end of the first 12 months of operation. This balance sheet will draw on the various figures you entered in the “Profit and Loss Forecast” tabs.

Finally, the “Break-Even Analysis” helps you find how many sales you need to have in that crucial first year. This number is meant to cover your fixed costs and eventually break even. You can enter figures in any white field, the yellows fields are calculated for you so there’s no reason to input data in these cells.

Why You Should Use the Financial Cash Flow Workbook

By using this important information to assess the incoming and outgoing cash flow of your business you gain a valuable insight into the value of your new venture in the first 12 months of operation. You need this information to properly analyze and develop new strategies to help grow and develop you market base. These steps are fundamental when creating a new business, why not have a little help to guide you through the process? Get the workbook today!

Download: Financial Cash Flow Workbook

Check out this offer while you wait!