When it comes to laying the foundation for a profitable business venture, it’s safe to say that tracking income and expenditures rank near the very top of priorities.

It’s the first step to initiating a solid cash flow. Once you’ve managed to grasp on a profit and loss balance, it can be easy to spot key paths for increasing company revenue streams and financial opportunity.

Granted, it’s not an incredibly simple feat. Tracking income and expenses takes sincere effort and application, especially for small businesses. And according to a recent info revealed by the United States Small Business Administration, nearly half of all young business crash, and inevitably sink, within their first five years. Not surprisingly, ‘insufficient capital’, or a dry bank account, was the number two culprit as to why so many small companies fail.

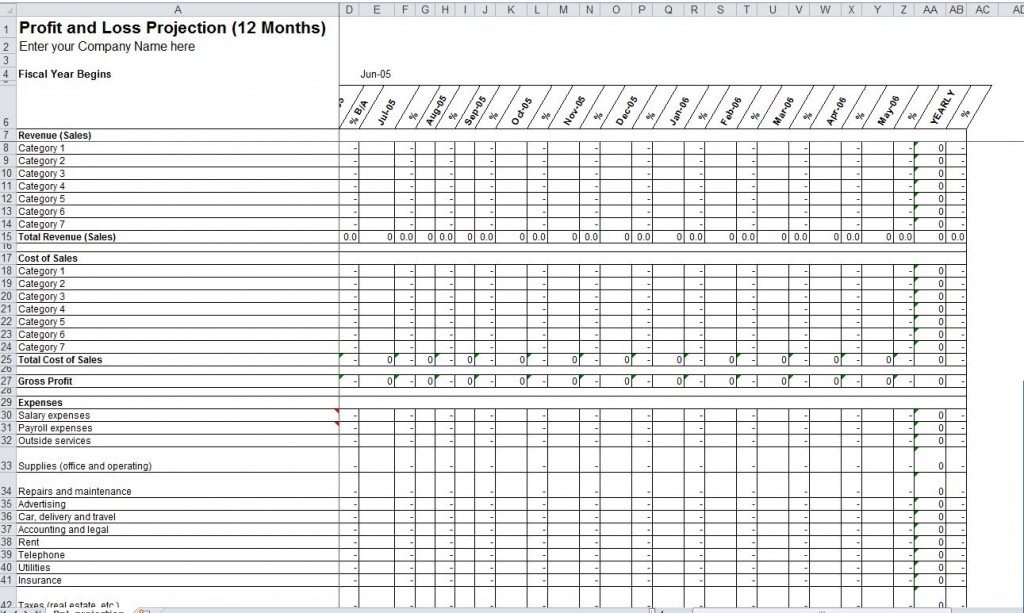

In light of the tendency for many small businesses to fall flat on their capital, staying on top of profit and loss – and in an organized fashion – is crucial for a flourishing business venture. And with the Profit and Loss Calculator for Excel, business owners can successfully:

- Forecast sales and expenses for a 12-month period.

- Assess your company’s major financial strengths, and weaknesses.

- Plan for future financial stability and success.

3 Steps To Using the Profit and Loss Calculator for Excel

- Project your future company sales and expenses. Make sure to take into account any major financial surges – or droughts – that might affect your revenue stream. Are the winter months particularly dreary? When might your biggest sales be, based off demographic buying tendencies?

- Begin to organize, and map, for the future. After you’ve had a chance to form an overarching lens of your company’s income statement, consider pinpointing any financial burdens that might be weighing your business down. Minus any fixed expenses like rent or utilities, are there any expense-eaters that you can effectively trim down, or do without?

- Check your Profit and Loss Calculator for Excel often. Planning for the future is merely an estimate. Your company will face inevitable financial obstacles throughout the year, so always be sure to include any major rifts, or upswings, in your Profit and Loss Calculator for Excel.

Download: Profit and Loss Calculator for Excel

Check out this offer while you wait!