For most Americans, the concept of retirement tends to be somewhat abstract.

Throughout our working lives, we are continually being advised to throw money into a future fund. But while we do our best to participate in 401K, IRA and stock programs, more than a few questions tend to be overlooked in the process:

What exactly am I saving for?

Will I be able to not work?

…am I saving enough?

Although adults can do their best to strategically plan for retirement, gearing for old age tends to mimic the predictions of an 8-Ball. As much as we diligently prep meeting our senior citizen status, fate tends to take the steering wheel at some point, as inevitable medical woes, economic downturns, and unforseen expenses play a significant role in our finances.

Retirement is completely dependent on future events. And it’s entirely capable of hindering your projected finances in old age without the proper necessitating.

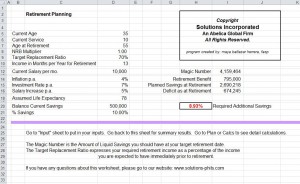

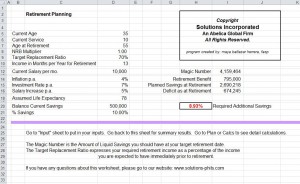

Given the interchangeable and unpredictable nature of retirement planning, any kind of meticulous planning – especially as a old age draws nearer – is crucial. But with the Retirement Planner Spreadsheet from MyExcelTemplates.com, potential retirees can assess their current financial status, coupled with their projected one in old age, in order to gauge an accurate retirement assessment.

How to Use the Retirement Planner Spreadsheet

- Fill in your current age, as well as a projected retirement age. These two numbers will lay the foundation for your financial retirement forecasting.

- Calculate your savings so far. This includes your total savings, 401K and IRA holdings, as well as any stock or bond funds. The Retirement Planner Spreadsheet contains specific locations for savings calculations.

- Configure your current income and expense ratio per month, and project that for the duration of your working life until retirement. Of course, this is merely a projection. Life is full of unpredictable obstacles, many of which will alter your current financial situation for better, or for worse.

- Determine how much you’ll need to sustain, and flourish, in retirement. Although most potential retirees are able to cover necessary living expenses in retirement, a sizable portion of adults fail to account for life’s unexpected expenses. Consider any current health problems that plague you, such as heart, weight or diabetes issues. These can all play a significant role in both your life expectancy, as well as potential care you might need in old age.

Download: Retirement Planner Spreadsheet

Check out this offer while you wait!