Keeping track of wages and salary information can be difficult as a small business owner. With employee pay varying and constantly shifting hours of work, it can get really hectic. The Salary and Wages Calculator was designed to help business owners and managers store this information and update it as they see necessary. With a few mouse clicks, the template calculates your employee’s pay if they worked more or fewer hours. You can even make individual pay stubs to give to your employees as well. If you’re ready to start organizing your business’s payroll information, read this information listed below to get started.

Using the Salary and Wages Calculator

You will first need to download the free template to your computer by clicking the link at the bottom of this page.

To change any of the pre-written information already in the document, just click the cell you wish to change and type something new to replace it.

The next step is to view the tabs at the bottom of this page. You can see that you will need to begin in the “Employee Information” tab to enter the essentials first. You will go through each column of this section, listing the Employee ID, name, wages, tax status, etc. until you have gone through the whole list: when you want to add another employee, simply move to the next row.

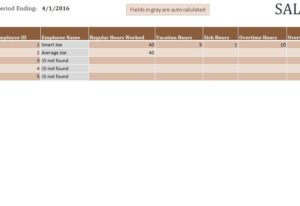

Next, head over to the “Salary Wages Calculator” tab to enter the changeable information, such as the number of hours they worked for the week and any overtime information as well. Just as you did before, fill out all the information listed in the first column.

When everything has been entered, you can click on the “Employee Paystubs” tab to print out a few sheets of paystubs for your employee’s tax records.

This simple template just makes managing payroll information simple and efficient.

Download: Salary & Wages Calculator

Check out this offer while you wait!