The Tax Liability Estimator is a free and easy way to calculate your possible tax liability for your business this year. It’s something all companies have to do for any taxable event so why not make it easier to store all your tax information and have calculations done for you by downloading this free template? This free liability estimator can help you easily sort through months and months of your tax information with the click of a button. Make tax season and any other taxable event that your business comes upon with the free Tax Liability template.

How to Use the Tax Liability Estimator

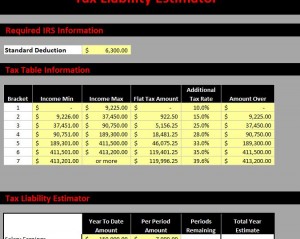

The first step after clicking the link below to download the template is to enter your standard deduction at the top of the page.

The document allows you to enter all this information in the main table below. As you can see from the main category headers at the top of the first table, you will enter specific information based on the category given.

For example, under the Income Max and Income Min columns, you will enter your business’s maximum and minimum income over the period you want to calculate. You can fill up to 7 different taxable events in this table.

Now, scroll down to the “Tax Liability Estimator” section of the page and continue to fill out your salary earnings and deductions. You will do the same with the next section, “Underpayment Checker” as well.

Only after all this information is filled will you be able to scroll to the very bottom of the page and receive your “Additional Required Payment to IRS to Pay 90% of Tax Liability” amount.

If you need a reference for any of the items listed in the template, you can click on the “(Filled Example)” tab that contains a sample of the sheet that has already been filled out.

Now you can get back to the important stuff by downloading this free template today.

Download: Tax Liability Estimator

Check out this offer while you wait!