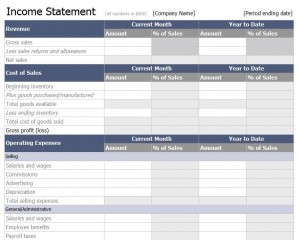

As a business owner, keeping track of your business’ revenue and expenses is a significant part of determining where your business financially stands. Microsoft Excel has created an Income Statement Template to complete such a task. This template allows you to record the finances of your business for the current month and the accumulation of the current year. This template can also calculate certain values automatically such as net income and percentage of gross sales.

It’s convenient for any business to obtain the Income Statement Template because it’s free to download on this very page. You can customize this template to your company’s distinguished style, be it a logo or just simply your company’s name. The Income Statement Template is easy to use and is sure to help increase efficiency and organization while reducing some of the accounting stress.

How to Use the Income Statement Template

- First, fill in your company name at the top center of the page and save it.

- Second, record the end date of the accounting period on the top right.

- Third, fill in all the white boxes in the row labeled “Amount” under “Current Month.” Blue boxes indicate that the values will be automatically calculated.

- Fourth, fill in all the white boxes in the row labeled “Amount” under “Year to Date.” This row is for values accumulated from the beginning of this year to the current month.

Tips for Using the Income Statement Template

- Keep each electronic statement for the current year on file. That way, it would be much more simple to calculate the “Year to Date” amounts each time.

- Keep both an electronic and printed copy of the filled in templates just in case you need to fax or physically give someone an income statement.

- Use the Income Statement Template to find any weak spots in your business’ financial income. For example, you may have spent too much on a certain item for your inventory rather than another item that is less abundant and much more needed.

Download: Income Statement Template

Check out this offer while you wait!