Value investors are driven to seek out stocks selling at a price below their intrinsic value. To evaluate the intrinsic value of a company, value investors are likely to rely upon an intrinsic value calculator to help them do the job. The calculator is a tool that helps the value investor separate real data from “noise” which they consider a premium that exists due to speculative assumptions of a company’s future earnings prospects.

Value investors are driven to seek out stocks selling at a price below their intrinsic value. To evaluate the intrinsic value of a company, value investors are likely to rely upon an intrinsic value calculator to help them do the job. The calculator is a tool that helps the value investor separate real data from “noise” which they consider a premium that exists due to speculative assumptions of a company’s future earnings prospects.

Using an Intrinsic Value Calculator

The intrinsic value of a stock is its market price plus or minus certain factors independent of its “book value” or liquidation value. The market price of any stock must discount into the present the future value of everything that can possibly happen to a company both good and bad.

This includes earnings and dividends, revenue growth, macro-economic conditions, interest rates, the outlook for the industry group the company is in, and such intangible things like goodwill, depreciation, depletion, and amortization. Stock price valuation can be a very subjective thing, and it is not uncommon for stock prices to fluctuate a great deal simply because of what information is presently circulating in the financial news media.

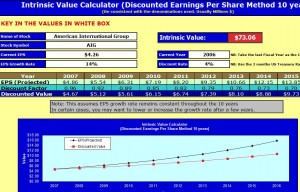

Any good intrinsic value calculator template will have columns of cells into which you will need to enter certain pieces of data. In the first available column, you will perhaps notice that you are instructed to input symbols for the stocks you want to compare against each other. This is a handy way to keep your results tidy and organized.

In the next available column, you should be directed to input the estimated EPS (earnings per share) growth rates for each issuer you want to investigate. This and the remaining data you need should come from the stock analysts. Next, you should input the projected EPS growth rates of each issuer based on previous history into the next available column.

The template will use the lower of these two values to make its calculations. The next step will require you to input the present PE ratio (price/earnings ratio) of each issuer into the next column. Finally, you should input the 10-year historical average of these PE ratios into the remaining column. Again, the template will use the lower of the two PE ratio figures to generate its calculation. When the last piece of data has been input into the spreadsheet, your intrinsic value calculations should appear before you automatically.

Download: Intrinsic Value Calculator

Check out this offer while you wait!