One of the best times to start a new budget is at the beginning of the year. All the holiday spending is done and you can begin tracking regular expenses. The 2015 Monthly Budget is a simple Excel template to track your income and expenses by the month to help you budget.

How to use the Excel Monthly Budget

Download the Excel sheet from the link below and open it to see a pre-populated form with examples to help you navigate. Start by entering the [Month] and [Year] you’re starting with and then skip over the graph section and “Cash Flow” column.

Start at the “Monthly Income” section. The column is divided into three parts: your projected (estimated) income, your actual income, and the automatically generated difference between the two. Before the beginning of the month, enter what you expect to bring in for the month, and then at the end of the month, fill in the actual amount. The blue variance column will show you the difference, and at the bottom the totals for each column will fill in.

The next column, expenses, works the same way. Enter your projected amount of expenses for each category (leave blank any that don’t apply), and then input the actual amount spent at the end of the month. The totals and variances will be calculated for you.

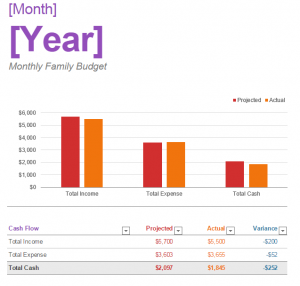

Scroll back to the top to the column labeled “Cash Flow” that you skipped. This will give you an overall summary of your projected, actual, and variance incomes and expenses along with their cash difference. The graph above will reflect those numbers.

Once the month has been filled out, you can see if you are spending too much or if you have cash leftover. Use this to compare month-over-month your spending habits, and see where you spend the most. This will help you create a monthly budget by seeing where you can cut expenses.

Tips for using the 2015 Monthly Budget

- When you start a new month, use the previous month’s “Actual” amounts as your projected amounts. This will give you a better idea of what you’ll have for the month.

- If you know there will be one big purchase (such as a car down payment) for a month, add it to just that month under “Other”.

Download the 2015 Monthly Budget

Template courtesy of Microsoft

Check out this offer while you wait!