Calculating your debt to income ratio is a free and healthy way of gauging your financial situation. You might be facing some heavy financial choices in the near future. Whether you’re considering buying a new home or even just a new car, it’s a good idea to calculate your debt ratio. This template is a fast and free way to learn where you stand when it comes to how much you earn and how much you owe. It also comes with a guide that shows you what your ratio means. Download this free template today to learn where you stand financially.

Debt to Income Calculator Instructions

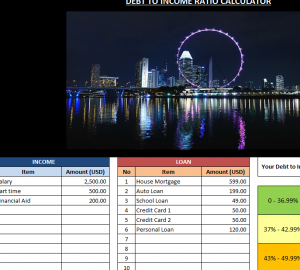

After clicking the link at the bottom of this screen to download the template, fill out the blue “Income” table to the left of your screen,

The “Income” section can include everything from your salary to federal aid. Anything that adds your personal income on a monthly basis will go into this table.

The next section, “Loan” will be the space where you enter all the debt you’ve accrued so far. The template gives you a few common examples of loan debt. Feel free to change these examples by clicking in the cell and changing the item to whatever you need.

Once you’ve entered all your items and amount, the template will give you your debt to income ratio to the right of your screen. Below your calculated ratio, you’ll see a chart illustrate where you stand with your debt on a monthly basis.

If your ratio falls into the green range, you’re in pretty good shape. If it’s in yellow, you’re still doing well; you should just try to avoid more credit card debt. The orange range suggests reducing your debt as quickly as possible and if you fall into the red, you should probably seek professional financial advice.

The Debt Calculator gives you the necessary tools to analyze your debt and come up with a strategy to help you reduce it.

Download: Debt to Income Calculator

Check out this offer while you wait!