The Oprah’s debt diet consist of eight steps to help you take charge of your finances and your life. It helps you uncover debt and find the reasons why you think this type of lifestyle is acceptable. Using the Oprah debt diet can help you take control of your finances and make better financial choices in the future! Step One: Find Out How Much Debt You Have Pull out all of your bills and manually track how much debt is owed. This step lets you see where you are financially so you can develop a plan pay off this debt and make better future financial decisions! As you track your debt and its reduction, keep track of your progress using an easy Excel spreadsheet. Your spreadsheet should list the amount of the debt, current payments, debtor name, payment status, and interest rate.

When you know your credit score, you know exactly how creditors view you and how your financial decisions have impacted this view. This three digit number tells your creditor the probability of your paying back money you borrow. Your credit score can influence:

- Interest rates when you purchase something on extended terms

- Employment consideration when applying for jobs

- Approval rating for home loans

- Approval for apartment rental

Step Two: Tracking Your Spending and Find Extra Money

Tracking your spending

As you go about your day, keep track of all receipts and spending that occurs. Put these expenses into an excel spreadsheet daily so you can see where your money is going. After a few days, review these expenses and note any extraneous or unnecessary splurges that need to be removed from your financial plan! Find extra money After tracking your spending, analyze where you are spending your money.

Prioritize your necessity spending versus your splurges.

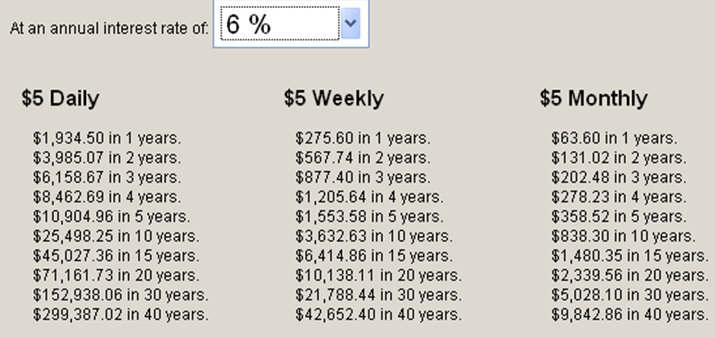

On your splurges or unnecessary spending, multiply those daily expense by 365 to see how much you could be saving per year! Your latte factor is that splurge spending that could be saved instead of recklessly spent! An example of this latte factor could be your daily Starbucks coffee. Instead of spending this money on a coffee drink every day, imagine investing it and it growing at an interest rate of 6%. In one year, you could earn nearly $2000 dollars! Here is a quick analysis of saving $5.00 a day at an interest rate of 6%.

Check out this offer while you wait!