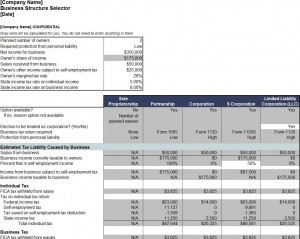

If you are thinking about starting a new business, you will need to decide what the best legal structure would be for your business. By developing the best legal structure you will ensure that your business has tax gain and legal protection benefits for your new business. This can be a difficult and confusing task, but we have a template that can help you by making the process much easier. Starting your own business is an exciting event in your life and you want to start off on the right foot, so we are providing you with a business structure selector template and instructions on how to fill it out. Remember that the template is free to use and is easily customized. You can download it right here, without having to go to any other site.

How to Use the Business Structure Selector Template

To get begin using the business structure selector, follow these steps:

- Download the Template

- Fill in the data that is unique to your company

- You do not need to fill in the area in grey, as the computer will automatically calculate the amounts.

Tips for Using the Business Structure Selector Template

First, choose from the following business structures

- Sole Owner

- Partnership

- Corporation

- S corporation

- Limited Liability Company

You might ask how to decide what type of business structure you are going to choose. Use the following tips to choose your business structure.

- Sole Proprietorship is the simplest type of business and the sole owner can use individual tax return to report earnings and expenses. Choose this option if you will be running your own business.

- Partnership is the type you will select if there are two or more owners of the prospective business. Each partner will contribute money and goods and will share in loss and profits. The company must make annual reports.

- Corporation will be the choice if the business is to be monitored by a board of directors and when there are shareholders that buy shares in the business.

- S Corporations are similar, but the corporation must have less than 75 shareholders, selecting to be considered as a special entity and the corporation is tax exempt.

- The Limited Liability Company (LLC) is a company where owners have limited liability for debts incurred by the company.

Download: Business Structure Selector

Check out this offer while you wait!