Breaking free from the thralls of debt can be an incredibly daunting process. Not only are indebted consumers facing a sizable negative number in their financial statements, but it’s a negative number that continues to compound, as unpaid credit card debts accumulate interest overtime.

And while the process is an undoubtedly nasty one, it’s a feat commonly faced by most Americans. According to Statistics Brain, the total amassed nationwide credit card debt is $793.1 billion. And from a more palpable perspective, the average household credit card debt reached an eye-watering $15,799 in 2012.

Although surfacing from suffocating credit card debt is is typically a high-priority goal for most Americans (or at very least, serious worry), most indebted consumers can feel confounded by the debt-alleviation process.

With interest rates compounding with every monthly missed, or late, payment, how on earth is escaping a five-figure credit card debt load even possible?

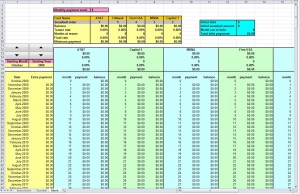

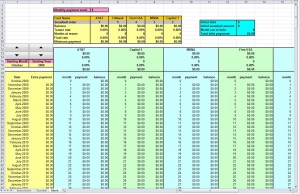

But as herculean of a feat as credit card payoff may seem, it’s not impossible. With the right tools, couple with a superior level of organization, escaping a crushing debt load is entirely achievable. And with the help of the Credit Card Payoff Calculator from MyExcelTemplates.com, indebted consumers can integrate the highly effective ‘snowball method’ to minimize their plastic debt-load.

Credit Card Debt, and Snowballs: What Gives?

When it comes to scraping off a serious debt load, conventional wisdom and intuition tells us to manage our most heavy debts first. After all, there the ones that will keep accruing interest if left unchecked.

But according to David Ramsey, creator of the financially innovative “Snowball Method” for credit card payoff, that conventional wisdom is reversed. According to Ramsey, indebted consumers should work on paying off their smallest debts first, in order to amass confidence and a sense of financial freedom. As the financial theorist suggests, the pattern will continue to pick up in speed (such as a rolling snowball would), accumulating more and more debt-payoff along the way. This is the central idea behind MyExcelTemplates.com’s Credit Card Payoff Calculator.

How to Use the Credit Card Payoff Calculator

- Designate the amount of money you can pay towards your credit card(s) each month. This can be found in the purple box marked “monthly payment available”. Feel free to plug in different numbers in this spot to see how your financial flow will fluctuate with different payments.

- Log the details of your credit card(s) in the orange boxes. Take note that the more credit cards you have, the more of a challenge the Credit Card Payoff Calculator will be. But although it’ll require more legwork, any kind of debt load will be escapable with the right kind of organization.

- If you have several credit cards, arrange the cards based on permutations. The calculator’s “Instruction” tab contains an area for this. The more cards you have, the more permutations you’ll have as well.

- Write down the number that appears in your “total debt payments” box after each individual permutation. You’ll be searching for the optimal combination to reduce this figure.

Download: Credit Card Payoff Calculator

Check out this offer while you wait!