The Dividend Discount Model (DDM) for valuation procedure for stock valuation that takes predicted dividend values and discounts to present value to evidence if DDM is higher than market price or not. Where higher, the stock contract is said to be under market. Companies report their valuation according to the DDM. Stock is worth the discounted sum of all dividend payments. This is a future forecast of stock value or net present value of forthcoming dividend payment.

The Dividend Discount Model (DDM) for valuation procedure for stock valuation that takes predicted dividend values and discounts to present value to evidence if DDM is higher than market price or not. Where higher, the stock contract is said to be under market. Companies report their valuation according to the DDM. Stock is worth the discounted sum of all dividend payments. This is a future forecast of stock value or net present value of forthcoming dividend payment.

Considering the Dividend Discount Model

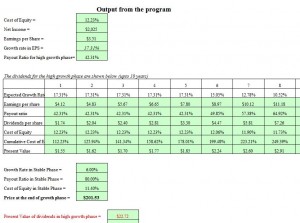

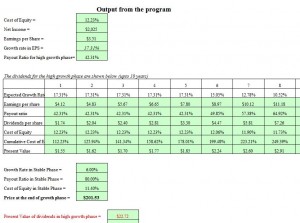

When considering DDM, the variables for computation use the current stock price as the constant growth rate. Constant indicates what value is expected for the dividends in perpetuity. This is also the constant cost of equity within a portfolio. The next year dividend forecast is a measure of valuation. A variation of DDM is supernormal dividend growth following a period of high growth, and subsequent lower consistent growth period.

Calculation of DDM computed according to net present value of cash flows. Growth ratios consider the return on equity (ROE) and multiplied by retention ratio or (1-payout ratio) and cannot exceed the growth equity.

The DDM equation is the basis for gauging investor’s required total return. Stock values that are the sum of a Company’s dividend yield (i.e. income) and its growth (i.e. capital gains) are equal to the required total return. Most analysts consider the DDM as a proxy for the projection of earnings.

Stock price and capital gains attribute more information to this prediction. Some problems indicated in application of the dividend discount model are that the presumption of a perpetual growth rate that is lesser than the cost of capital is not sufficient.

DDM assumes that companies have stock dividend shares for basis of valuation. Companies without shareholdings cannot employ DDM to calculate value of holdings. Investor reporting relying upon DDM where share holdings are present, may also be subject to externalities impacting valuation.

Interference by the market itself will influence actual dividend payouts, and this cannot be assessed by the model. Recent changes in stock market regulatory reform that may impact actual projections are not accounted for by the DDM, for example. For more information about dividend discount model consult financial guidelines.

Download: Dividend Discount Model

Check out this offer while you wait!