If you think you’re ready to buy a house, it’s important to start by figuring out the costs of purchasing a house. Factoring together down payments, payments by month over x amount of years, projected income, and more must all be considered. The Housing Expense Calculator will help you figure out the true price of buying a house.

How to use the Housing Expense Calculator

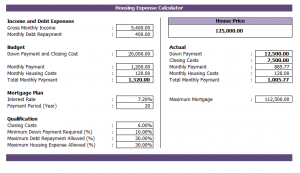

Download the two page calculator and open it in Excel. The first page is just a basic information collector. Input the interest rate you’re given during a house-buying estimation, along with how many years you want to be paying for the house, and finally what you expect to pay monthly. After this is entered, the total, real house price will show on the right.

For a more advanced look at housing costs, go to the bottom of the page and select “Advanced Expense Sheet”. Here, you can enter much more precise information such as your own income and debt, along with factoring in the closing costs and qualification rates.

Tips on using the Housing Expense Calculator

- It would be most beneficial to bring this document to your realtor. Meet over dinner at Red Lobster or a casual setting and you can enter in different percentages to figure out the best housing options for you.

- This tool is great for figuring out what houses would be in your price range, so when you do begin shopping, you won’t fall in love with a dream house you’ll never, ever be able to afford.

- Consult friends who have bought houses and have them enter their expense information to get a realistic idea of what everything should look like. For instance, you probably won’t be paying off a house in just 10 years, and your friends will show you why that’s very improbable.

Download: Housing Expense Calculator

Check out this offer while you wait!