Business owners and freelancers alike, rejoice! The Itemized Deductions Checklist makes it easy for anyone that uses itemized deduction when filing their taxes to keep track of all their information throughout the year. No more looking around for old receipts and struggling to prove that you bought the things you paid for. Now, you’ll be saying “Show me the Morty!” when tax season comes around and you won’t miss out on a single penny. If you want to get your tax information organized for this year and every one after, download the free template today.

How to use the Itemized Deductions Checklist

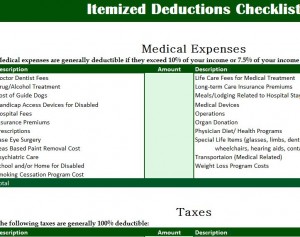

After downloading the free template to your computer, you will automatically start on the first tab of the template.

At the top of each section, a major expense is listed above every table downward. When you need to list an expense, simply find the category and enter all the corresponding information (description and amount).

The template will automatically calculate the total based on the information you provided for each category as a whole.

Remember to keep updating your table with all these important expenses as they come to avoid having a major tax breakdown at the beginning of the New Year.

As you make your way down the document, you will find the “Grand Total” column at the very end. This amount is the total accumulation of all the categories you have entered and the amount you will use when you finally get around to filling your taxes.

If you need to print the document for any reason, simply click “File” then “Print” at the top of your screen.

You can stay up to date on all your tax information through the year instead of sweating when it’s time to sit down and crunch numbers. Have all your tax information ready and waiting for you by downloading the free Itemized Deductions Checklist today.

Download: Itemized Deductions Checklist

Check out this offer while you wait!