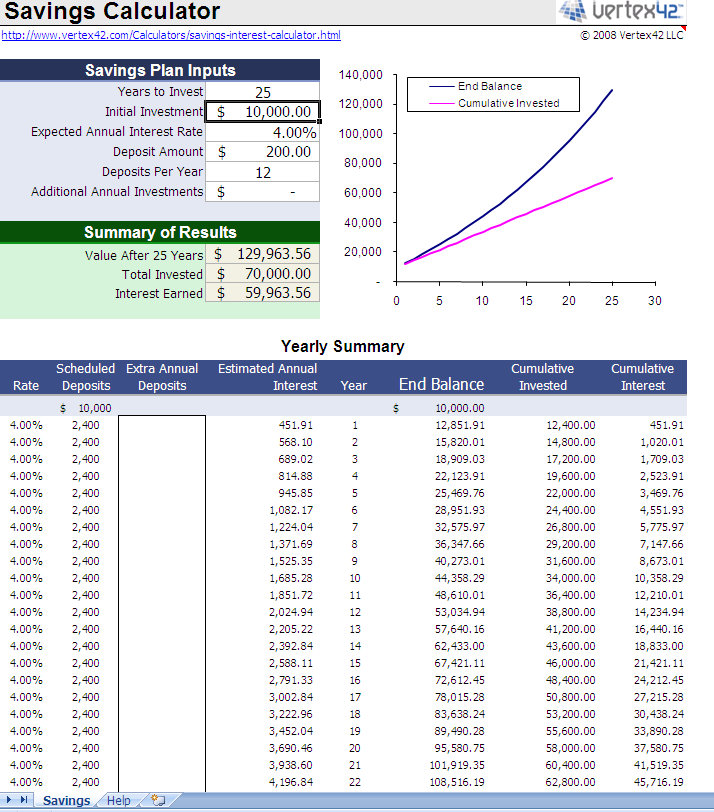

Learn to take charge of your finances by using tools that you have at hand. Utilize excel templates to manage your finances by letting their automatic calculators show you how your money can grow by taking simple steps to save!

Personal IRA – Taking Charge of Your Retirement Income

You have to do something today to make sure that you will have enough funds when you retire from employment. It does not really matter whether you are a simple employee or a businessman. The target retirement income amount may vary but the fact remains that we all need some amount of money to live on during the time when we are no longer able to work for a living. An Individual Retirement Account or an IRA is one of the instruments that you can use to take charge of the way your retirement income instrument is set up. An IRA allows you to choose from a host of retirement accounts and employ a variety of investment strategies in order to come up with the kind of retirement income accumulation that you intend.

As compared with a 401k plan, an IRA provides more options and allows for more flexibility. This means that you are not limited to particular investment instruments or investment strategies that are put in place by your employer as in the case of 401k plans. Those whose employer 401k programs are set in place and managed using sound financial planning analysis are in good shape. Those, however, who would much rather make the investment decisions themselves would be better off with their own personal IRA. This makes not only stock and bond market instruments but other instruments as well including index funds.

An individual account would be a good option for you if you are financially savvy and know how to read the economic scenario quickly. You have to know how to do your own financial planning analysis if you are to maximize earnings on your IRA. You would not want to miss out on great opportunities to earn more on your money by having to dilly-dally around on an investment decision. It is important to have a good grasp of investment concepts when you decide to set up your own individual retirement account.

Additional Excel Templates can be found here.

Check out this offer while you wait!