For business owners, tracking asset depreciation rate is important to remaining up-to-date on the financial value of business assets. Using the straight line depreciation calculator excel is a fabulous way to do this. With the straight line deprecation calculator tracking your assets and their corresponding depreciation is easy. The straight line depreciation calculator excel is free to download, easy to use and completely customizable to your business.

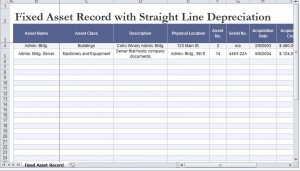

With the straight line depreciation calculator, you will be able to create columns for each asset, as well as assign your assets a column based on desired criteria such as serial number, asset description and physical location, estimated useful life, as well as straight line depreciation value and the salvage value of the asset. Whatever columns you wish to make, the straight line depreciation calculator template will easily allow you to do so.

Steps to Using the Straight Line Depreciation Calculator

Using the straight line depreciation calculator excel is relatively simple:

- Step 1. Using the template take the time to label the columns for each asset. To label the columns where there maybe example information given, simply click the example text and type over it with desired text. You can follow this process to label all columns as needed. If you find that you need more or fewer columns than given, right click the column and select “add” or “delete” until you have reached the desired number of columns.

- Step 2: Once you have appropriately labeled the columns, choose and select the cell which is designated for the depreciation amount. Then click to enable editing within the in the cell.

- Step 3: Now all that you have to do is enter the range of cells numbers containing the cost of the asset when you purchased it, the value it will have at the end of its depreciation, which is more commonly called the assets salvage value, and finally the value reflecting the useful lifetime in years. Once you have filled the values in the template will automatically calculate the straight line depreciation value of the listed assets for you.

The straight line depreciation calculator is a magnificent way to help business owners keep a firm grasp on the value of their assets. Using the template allows for quicker and easier completion than would be possible using just an excel spreadsheet. Additionally, the template already has the necessary formulas built within so all you have to do is enter your business name, asset information and values, then all the work is done for you.

Download the Straight Line Depreciation Calculator from Microsoft Office: Straight Line Depreciation Calculator

Check out this offer while you wait!