If you run a firm one of the most dreaded terms that on the back of your mind, especially if you haven’t been doing well or you’re just starting out is bankruptcy. The free Z-Score Bankruptcy Template uses the Z-score formula to determine, quickly and effortlessly, if your firm will go bankrupt within the next 2 years of operation. You may not like the thought, but it does happen from time to time and you need to prepare yourself if it happens to you. If you’re ready to try this free template, just download the free document and follow the guide illustrated below.

Using the Z-Score Bankruptcy Template

To download the free Z-Score Bankruptcy Template, follow the link at the bottom of this page.

Your first step is to enter the company name and the current date at the very top of the template page. You can enter new items or replace old ones simply by clicking a link and typing something new.

Z-scores are typically used to predict corporate defaults calculate the control measures of any financial distress status of your business or company.

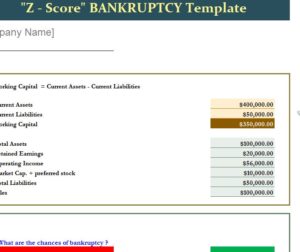

Start by entering your data in the first table of the document. This will include your current assets and liabilities. The template will give you your working capital.

Continue to fill out the information in the next few cells of this table as well.

The template will then show you the probability of your firm going bankrupt within the next two years and your Z-score. If you’re in the green then you’re good to go, no worries. The template shows you a color-coordinated scale off to the left of this table to illustrate the different ranges as well.

At the very bottom of the template, you can see the different formulas used to calculate your Z-score. This is good information to know going into a new business and could help you develop new strategies for keeping your business afloat.

Download: Z-Score Bankruptcy Template

Check out this offer while you wait!